The operating

system for

The operating

system for

The operating

system for

tokenization

Infrastructure, issuance, compliance, liquidity - all built in.

Secure early access

The operating

system for

tokenization

Infrastructure, issuance, compliance, liquidity - all built in.

Secure early access

"

*BCG Report “On-Chain Asset Tokenization”

(June 2023). Projects tokenized assets to reach

$16 trillion by 2030, representing 10% of global GDP.

*BCG Report “On-Chain Asset Tokenization” (June 2023). Projects tokenized assets to reach $16 trillion by 2030, representing 10% of global GDP.

*BCG Report “On-Chain Asset Tokenization” (June 2023). Projects tokenized assets to reach $16 trillion by 2030, representing 10% of global GDP.

Built & Regulated in the U.S.

All RWAs, one TX

All RWAs, one TX

From issuance to global distribution, TX covers the full tokenization lifecycle. Powered by an SEC-registered broker-dealer to enable compliant primary offerings and secondary trading.

From issuance to global distribution, TX covers the full tokenization lifecycle. Powered by an SEC-registered broker-dealer to enable compliant primary offerings and secondary trading.

Infrastructure layer

Infrastructure layer

A purpose-built PoS blockchain designed for compliance, speed, and interoperability.

A purpose-built PoS blockchain designed for compliance, speed, and interoperability.

White label app

White label app

Plug-and-play dashboards and tooling to issue/manage RWAs without writing code.

Plug-and-play dashboards and tooling to issue/manage RWAs without writing code.

Distribution network

Distribution network

Shared onboarding and B2B2C distribution: TX completes KYC once & syndicates access across partners.

Shared onboarding and B2B2C distribution: TX completes KYC once & syndicates access across partners.

TX provides the rails, the exchange, and the standard for RWAs.

TX provides the rails, the exchange, and the standard for RWAs.

Why now?

It’s not about speculation anymore.

Why now?

It’s not about speculation anymore.

Why now?

It’s not about speculation anymore.

Why now?

It’s not about speculation anymore.

Institutional forecasts

Institutional forecasts

‘16T by 2030’

- Boston Consulting Group 2

‘16T by 2030’

- Boston Consulting Group 2

Institutional buy-in

Institutional buy-in

Capital and infrastructure deployment:

- Blackrock (BUIDL)

- USB (uMint)

- Temasek & ADIA back tokenized private markets

Capital and infrastructure deployment:

- Blackrock (BUIDL)

- USB (uMint)

- Temasek & ADIA back tokenized private markets

Real-world implementation

Real-world implementation

$24B+ assets already on-chain, RWAs as crypto’s fastest growing sector. 3

$24B+ assets already on-chain, RWAs as crypto’s fastest growing sector. 3

2015

2020

2025

2030

A turnkey product suite for tokenization

A turnkey product suite for tokenization

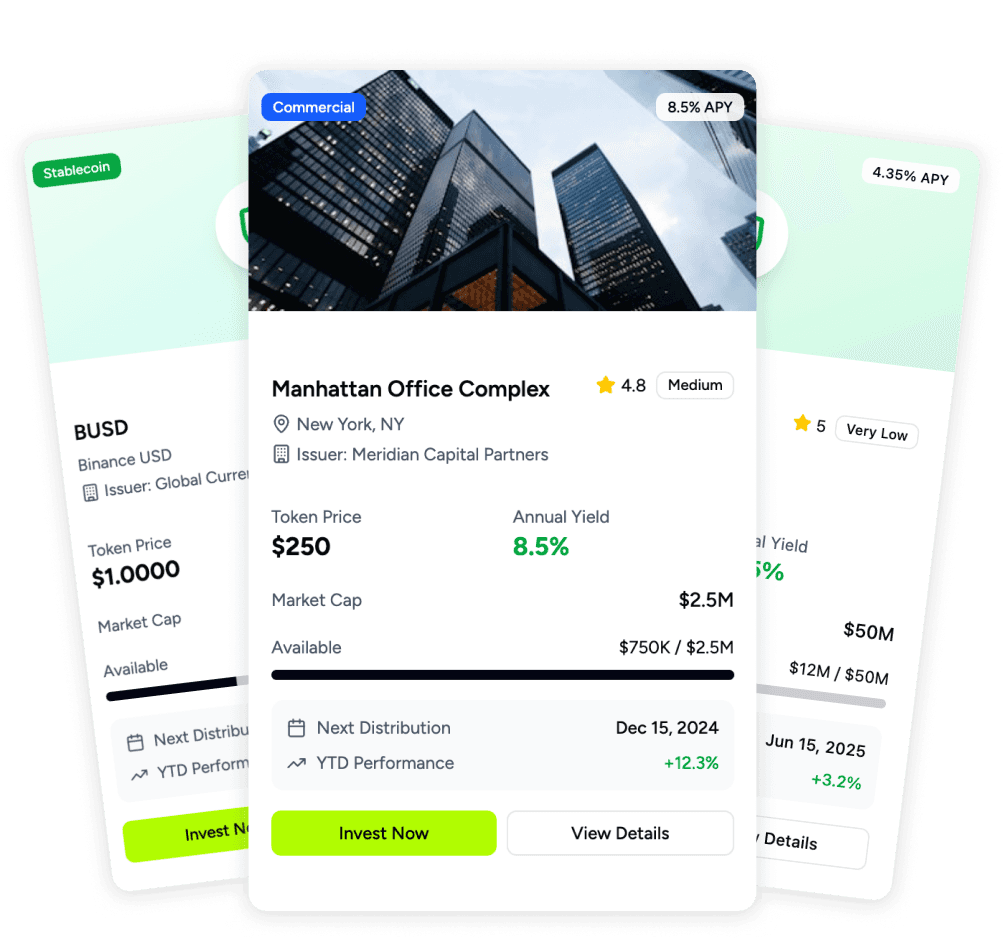

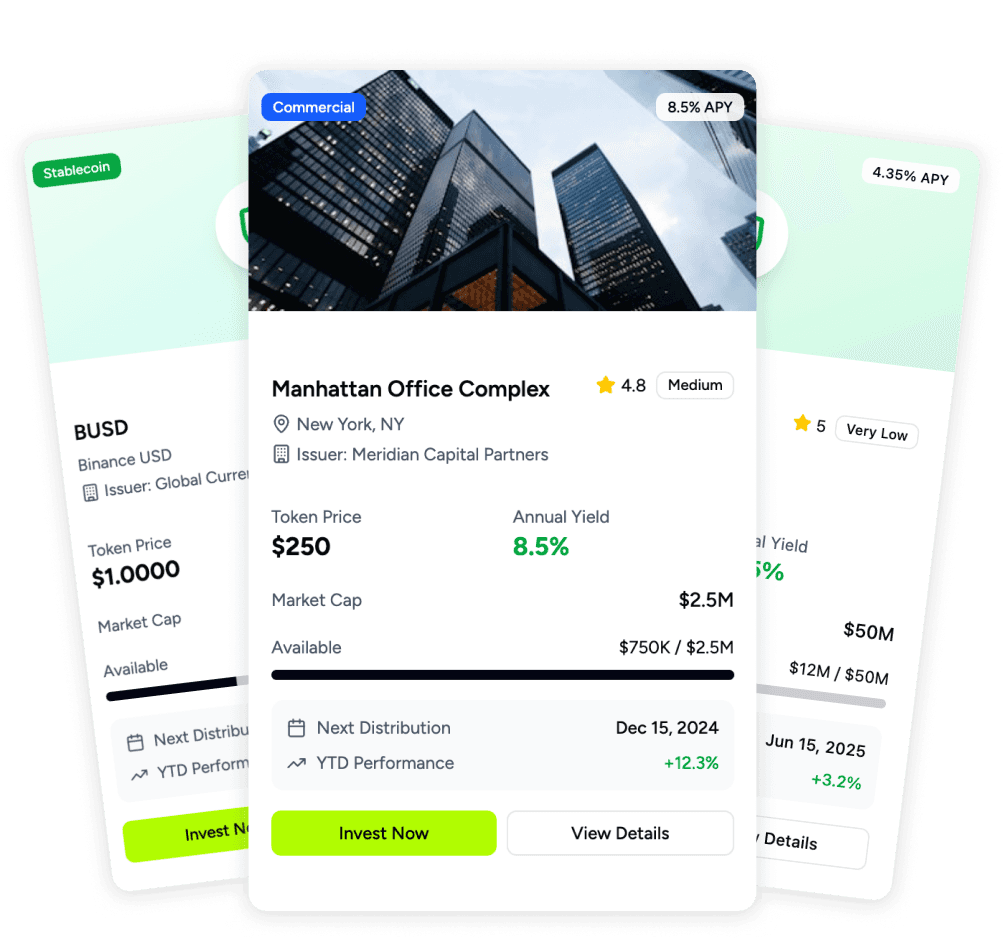

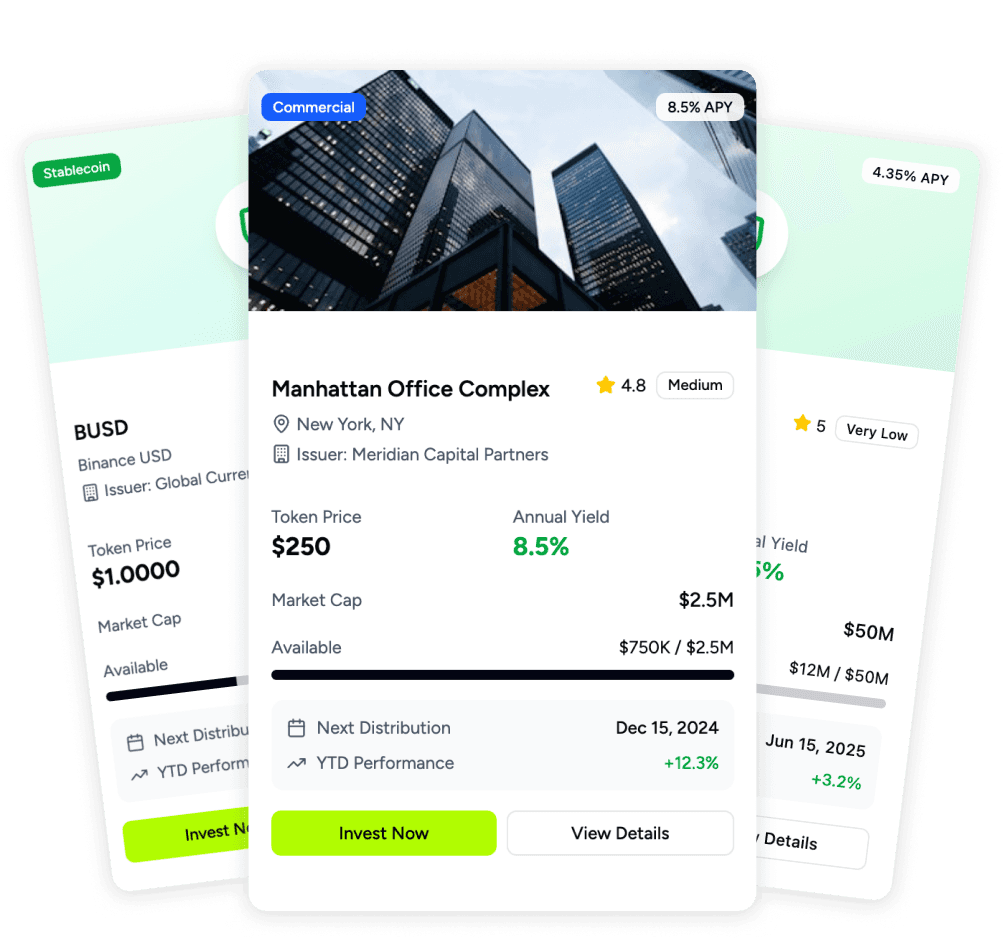

RWA marketplace

RWA marketplace

Discover, invest, and trade across a wide array of real-world assets in one unified user experience.

Discover, invest, and trade across a wide array of real-world assets in one unified user experience.

TX order book

TX order book

Native secondary markets with programmable compliance. I.e. jurisdiction limits, investor tiers, and lock-up periods.

Native secondary markets with programmable compliance. I.e. jurisdiction limits, investor tiers, and lock-up periods.

Cross-chain bridge

Cross-chain bridge

Move value seamlessly across XRPL, Cosmos & EVM blockchains.

Move value seamlessly across XRPL, Cosmos & EVM blockchains.

Issuer cockpit

Issuer cockpit

White-label dashboards to issue and manage assets with no code.

White-label dashboards to issue and manage assets with no code.

RWA marketplace

Discover, invest, and trade across a wide array of real-world assets in one unified user experience.

TX order book

Native secondary markets with programmable compliance. I.e. jurisdiction limits, investor tiers, and lock-up periods.

Cross-chain bridge

Move value seamlessly across XRPL, Cosmos & EVM blockchains.

Issuer cockpit

White-label dashboards to issue and manage assets with no code.

A complete catalogue of tokenized assets

A complete catalogue of tokenized assets

Equities

Equities

U.S. public stocks

U.S. public stocks

Global equities

Global equities

Pre-IPO shares

Pre-IPO shares

Real estate

Real estate

Residential units

Residential units

Commercial buildings

Commercial buildings

REIT shares

REIT shares

Intellectual property

Intellectual property

Patents & music royalties

Patents & music royalties

Film revenue participation

Film revenue participation

Book IP & licensing deals

Book IP & licensing deals

Sports

Sports

Fan tokens

Fan tokens

Media rights

Media rights

Fractional team ownership

Fractional team ownership

Supply chain

Supply chain

Invoice receivables

Invoice receivables

Equipment leasing

Equipment leasing

Warehouse receipts

Warehouse receipts

Commodities

Commodities

Gold & oil

Gold & oil

Carbon credits

Carbon credits

Lithium

Lithium

Art & collectibles

Art & collectibles

Artworks

Artworks

Luxury watches

Luxury watches

Historical items

Historical items

Stablecoins

Stablecoins

Fiat-backed (USD, EUR, SDG)

Fiat-backed (USD, EUR, SDG)

Gold-backed

Gold-backed

Crypto-backed

Crypto-backed

Bonds & yield instruments

Bonds & yield instruments

U.S. treasuries

U.S. treasuries

Global sovereign debt

Global sovereign debt

Structured notes

Structured notes

Request early access

Request early access

Request early access

Secure a spot on the whitelist. Institutional partners are welcome.

Disclaimer

1.

Via integration with a registered U.S. broker-dealer.

2.

BCG Report “On-Chain Asset Tokenization” (June 2023). Projects tokenized assets to reach $16 trillion by 2030, representing 10% of global GDP.

3.

Redstone Finance, “Real World Assets in On-Chain Finance” (June 2025). Available here.

Copyright © 2025 TX Labs. All rights reserved.